Why trade crypto with JustMarketExpert?

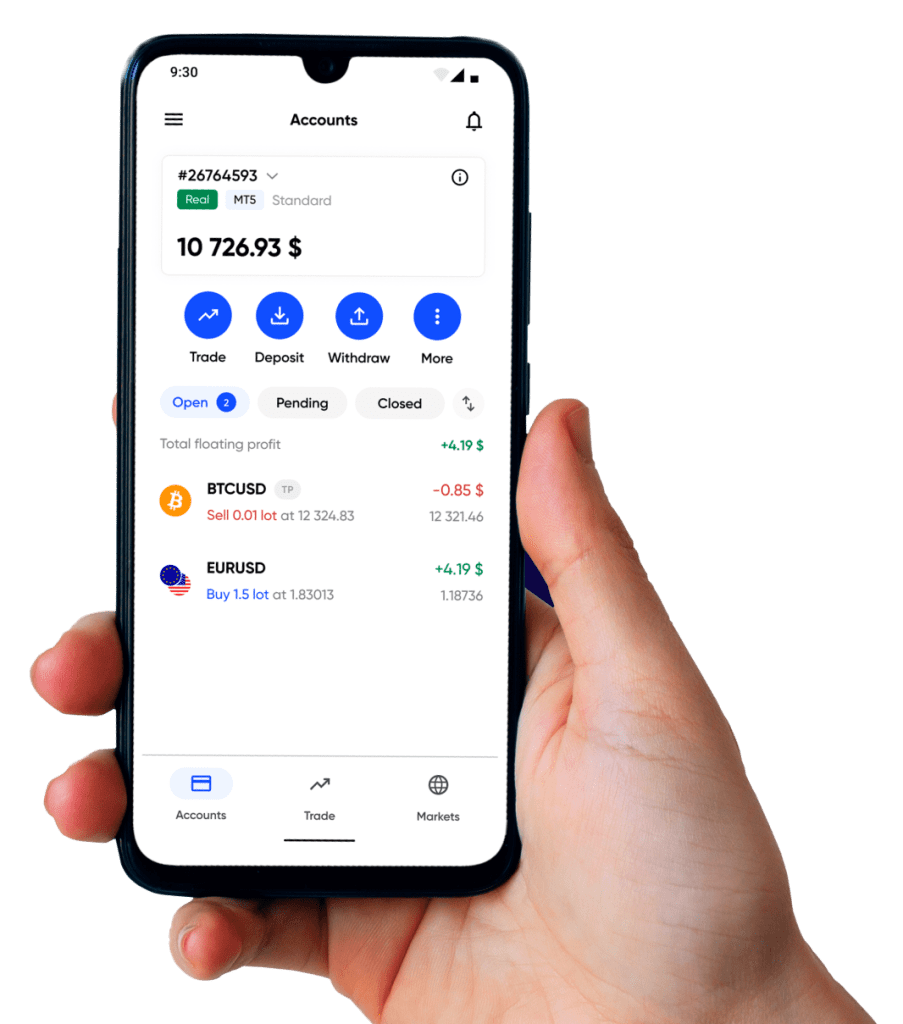

From the pioneering Bitcoin to the innovative Ethereum and Litecoin, JustMarketExpert offers you a platform to track and trade the movements of top cryptocurrencies under premium market conditions.Diverse crypto derivatives

Engage with the ever-evolving crypto market at JustMarketExpert. Tap into the potential of both the bull and bear trends of prime cryptocurrencies without the need to own the actual assets.

Swap-free trading

Every trader at JustMarketExpert has access to swap-free trading with no additional requirements, allowing to hold trades without extra charges.

Quick withdrawals

Get your money fast when you want to take it out. Choose from various payment methods and get quick approval for your requests.

Gap protection

Trade without worry with our gap protection. It prevents slippages, so your trades start and end right where you expect, without missing any small price changes.

Investment security

Invest in commodities with Negative Balance Protection. When a negative balance takes place because of a sharp movement on the market, it will be set to zero in order to protect the clients from the unexpected losses.

Fast order execution

At JustMarketExpert, your deals are done almost instantly. In just fractions of a second, we ensure that your trades are executed, giving you the speed you need to trade effectively.

Crypto market instruments

- Standard

- Pro

- Raw Spread

Avg.spread

pips

Commission

per lot/side

Margin

1:3000

Long swap

points

Short swap

points

Stop level*

pips

Crypto

UNIUSD

Uniswap vs US Dollar

Extended Swap-free available

TRXUSD

Tron vs US Dollar

Extended Swap-free available

AVXUSD

Avax vs US Dollar

Extended Swap-free available

XRPUSD

Ripple vs US Dollar

Extended Swap-free available

XLMUSD

Stellar vs US Dollar

Extended Swap-free available

SOLUSD

Solana

Extended Swap-free available

MATUSD

Polygon

Extended Swap-free available

LTCUSD

LiteCoin vs US Dollar

Extended Swap-free available

LNKUSD

Chainlink vs US Dollar

Extended Swap-free available

KSMUSD

Kusama

Extended Swap-free available

ETHUSD

Ethereum vs US Dollar

Extended Swap-free available

EOSUSD

EOS vs US Dollar

Extended Swap-free available

DOTUSD

Polkadot vs US Dollar

Extended Swap-free available

DOGUSD

DogeCoin vs US Dollar

Extended Swap-free available

BTCUSD

BitCoin vs US Dollar

Extended Swap-free available

BCHUSD

BitCoin Cash vs US Dollar

Extended Swap-free available

ADAUSD

Cardano vs US Dollar

Extended Swap-free available

Crypto market conditions

Dive into the innovative realm of cryptocurrencies, a marketplace built on blockchain technology to create and exchange digital coins. Trading with JustMarketExpert gives you the opportunity to follow the volatility of cryptocurrency prices and leverage your online portfolio without the need to own the underlying assets.

Trading hours

With JustMarketExpert, you can engage in cryptocurrency trading around the clock, 24/7, except during our scheduled server maintenance periods. We will keep you updated via email and news on our website.

The following cryptocurrency pairs have daily trading breaks from 00:00 to 00:05: BTCUSD, BCHUSD, ETHUSD, LTCUSD, XRPUSD.

All timings are in server time (GMT+3).

Spreads

Spreads in the crypto market frequently float. The spreads mentioned above are averages from prior trading days. Check our platform for current spreads.

Spreads may increase during periods of low liquidity. This includes times such as market rollover and may continue until normal conditions resume.

Our best spreads are guaranteed on our Raw Spread account, where spreads start from 0.0 pips.

Swap-free trading

Swap is the interest fee charged on trading positions that remain open overnight. The swap rates vary across different trading pairs. Swaps are applied at 22:00 GMT+3 each day, excluding the weekend, until the position is closed. It is important to note that swaps on Wednesdays are tripled to account for weekend funding costs.

You won`t be charged for the instruments marked “Extended Swap-free available” in the table above if you have swap-free status.

All customer accounts from any country are automatically given swap-free status.

Stop level

Pay attention that the stop level values indicated in the table above are variable and might not be accessible for traders employing specific high-frequency strategies or utilizing Expert Advisors.

Fixed margin requirements

The margin requirements for all cryptocurrency pairs remain fixed, irrespective of the leverage applied to your trading account.

Frequently asked questions

Crypto, short for cryptocurrency, refers to digital or virtual currencies that use cryptography for security. They operate on decentralized networks based on blockchain technology. Cryptocurrencies are not controlled by any central authority, making them theoretically immune to government interference or manipulation.

Blockchain technology is a decentralized ledger that records all transactions across a network of computers. It ensures security and transparency as every transaction is added as a new block to the chain and cannot be altered. This technology underpins cryptocurrencies, allowing secure and anonymous transactions without the need for a central authority.

Bitcoin, created by an unknown person using Satoshi Nakamoto’s pseudonym in 2009, is the first and most well-known cryptocurrency. It’s a decentralized digital currency that allows peer-to-peer transactions without a central authority. Bitcoin transactions are verified by network nodes through cryptography and recorded on a public ledger called a blockchain.

There are numerous cryptocurrencies available for trading beyond the well-known Bitcoin and Ethereum. These include Ripple (XRP), Litecoin (LTC), Cardano (ADA), Polkadot (DOT), and more. The availability of specific cryptocurrencies for trading varies depending on the platform or exchange you use.

Yes, many trading platforms offer leveraged trading for cryptocurrencies. Leverage allows you to trade larger amounts than your current capital, potentially increasing your profits. However, it’s important to remember that while leverage can amplify gains, it also increases the risk of higher losses.

Yes, unlike traditional stock markets, cryptocurrency markets operate 24/7, allowing trading over the weekends. This is because cryptocurrencies are decentralized and not tied to any particular geographic region or central regulatory body.